Full form of MICR

MICR stands for Magnetic Ink Character Recognition.

The Magnetic Ink Character Recognition Code is character recognition system which widely used by the banks to identify the originality of the document and to make the process easy and cheque clearance and also other documents. This technology is used with the help of special Ink and characters.

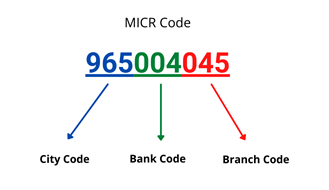

MICR code is printed on the bottom of cheques and it consists of nine digits.

The first three digits indicates for the city code,

The next three codes indicates the bank code and

Last three digits indicate the branch code. Thus, this is called MICR Code.

History

In the earlier days, the process took lots of time in their clearance due to the manual processing of cheques. The numbers of cheques were increasing day by day and so the process became difficult.

The first system was developed by the Stanford Research Institute and General Electric Computer Laboratory to process the cheques using MICR, during the period of mid 1950s.

Working Process of MICR

MICR code available on the document using two types of fonts and which are E-13B and CMC-7, and the ink used in it is magnetic ink.

MICR code passes through the MICR reader and it allows the characters to read easily which covered by the other marks such as, signatures and stamps.

Example

Features of MICR Code

It has small error rate.

Provides high level security for document forge, it is critical to follow the particular Ink.

If MICR fonts do not fulfill the high standard demand, they are rejected.

Even there is some signature or stamp on it, it can read easily.

Other than the normal cartridges, the MICR cartridges are very expensive.